OBJECTIVE

Hartford Insurance reached out to Wipro Digital to rethink the customer experience. Hartford Insurance is a well-established insurance company that enjoys a reputation of trustworthiness among its loyal customers. However, the insurance company—especially auto insurance—is experiencing new competition from digital startups disrupting the industry. Hartford Insurance needed to adopt the human-centered design thinking and digitization that is propelling new startups that are not weighed down by legacy systems and a “business as usual” culture.

RESULTS

We conducted a client workshop that took place over 2 days in Hartford, Connecticut. We brought together a diverse team of designers, engineers, industry experts and Hartford executives. Our focus was on improving the customer relationship, engaging with them early and providing them with the support they need in the event of an accident.

Over 50 digital products were proposed to help guide the customer through their entire journey from the initial accident to the settlement of the claim. This digital transformation was key to helping them overhaul key aspects of the customer experience and gain more leverage in an ever-crowded market.

PROCESS: RESEARCH

Stakeholder Interviews

We began by interviewing Hartford executives, and continued our discussions with industry insiders, and technology experts.

Customer Interviews

We conducted man-on-the-street interviews to ask them about their relationship with their car insurance, focusing on their experience filing an insurance claim. These interviews provided us with important qualitative information that included their thoughts, feelings and frustrations dealing with their insurance provider.

Onsite Client Workshop (view here)

A “war room” was set up at the headquarters in Hartford, Connecticut where we conducted a 2-day co-creation workshop focusing on ways to improve Hartford’s claim process and aid in the user’s experience, beginning with the initial accident.

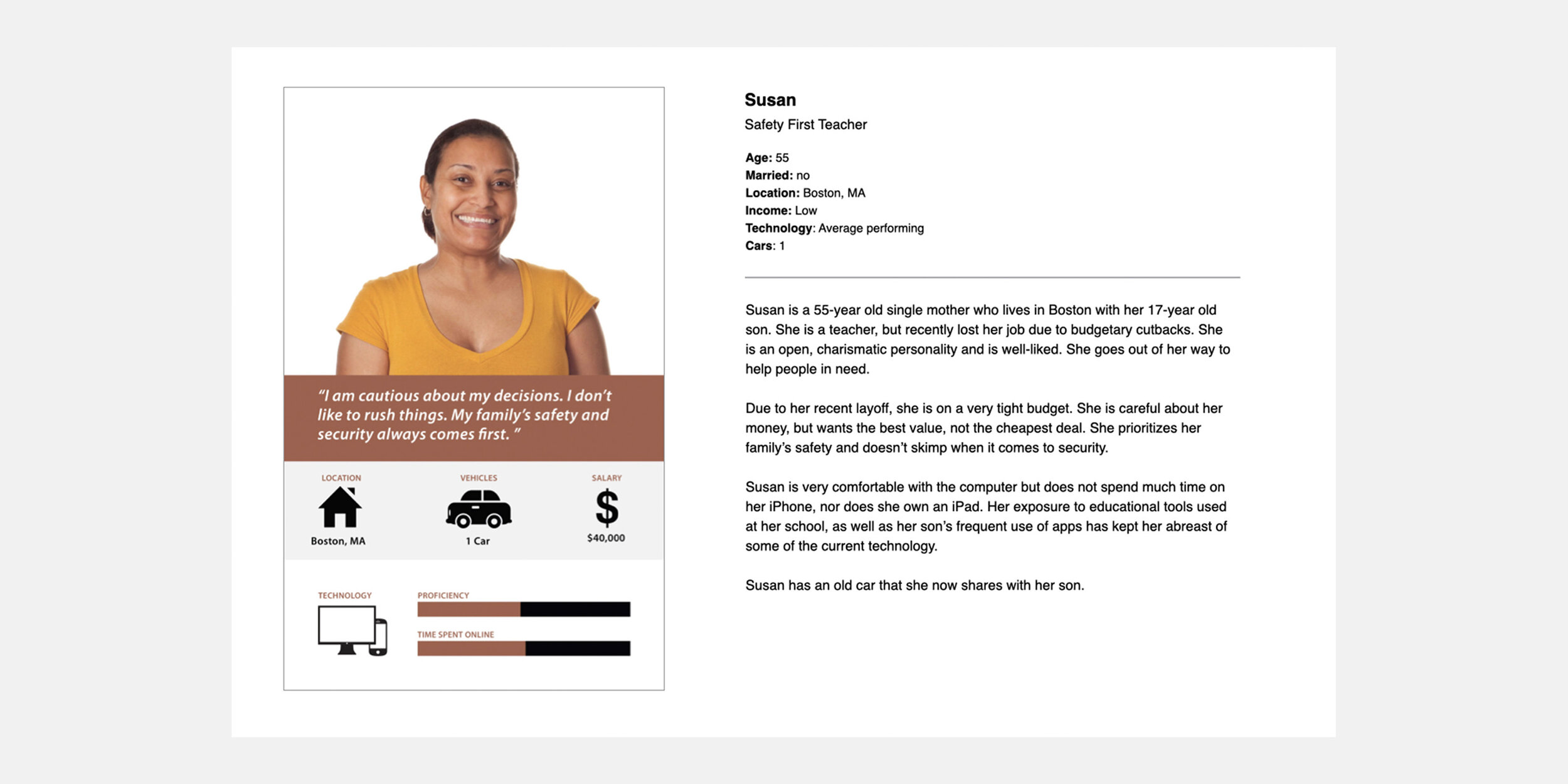

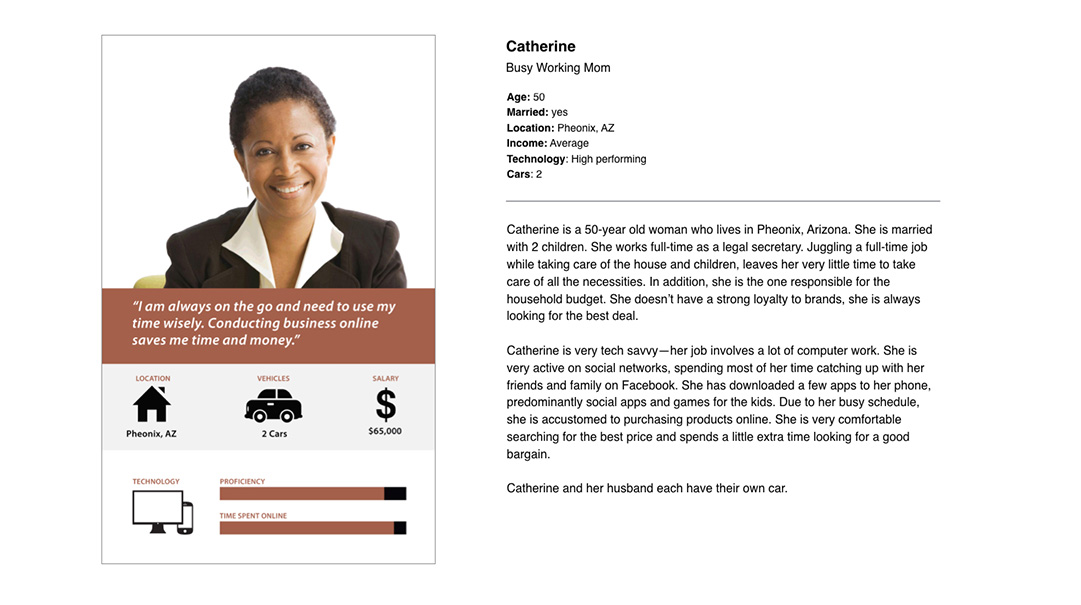

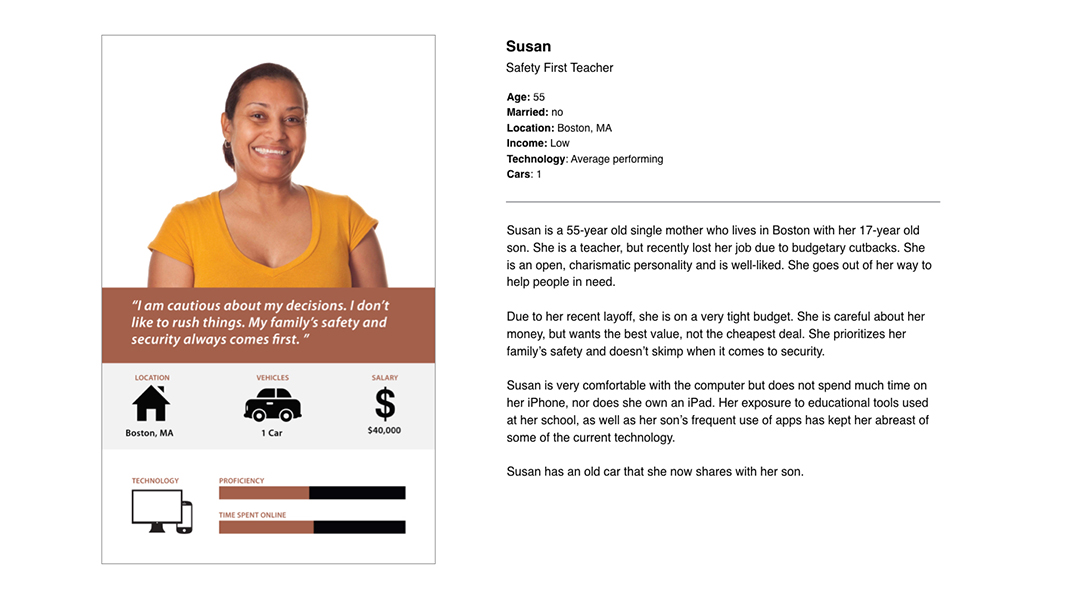

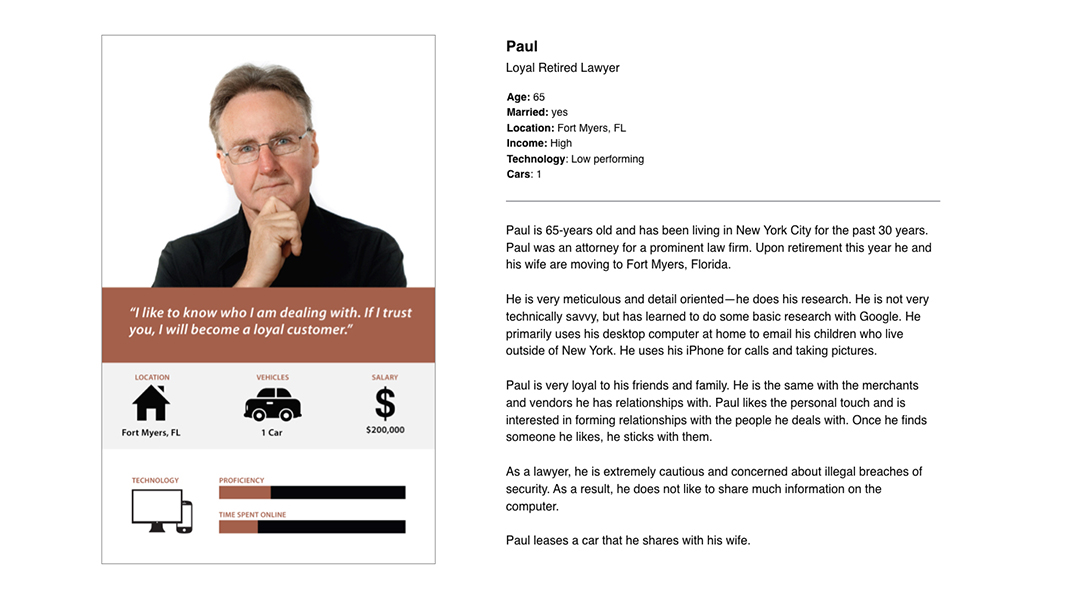

Personas & Journey Map

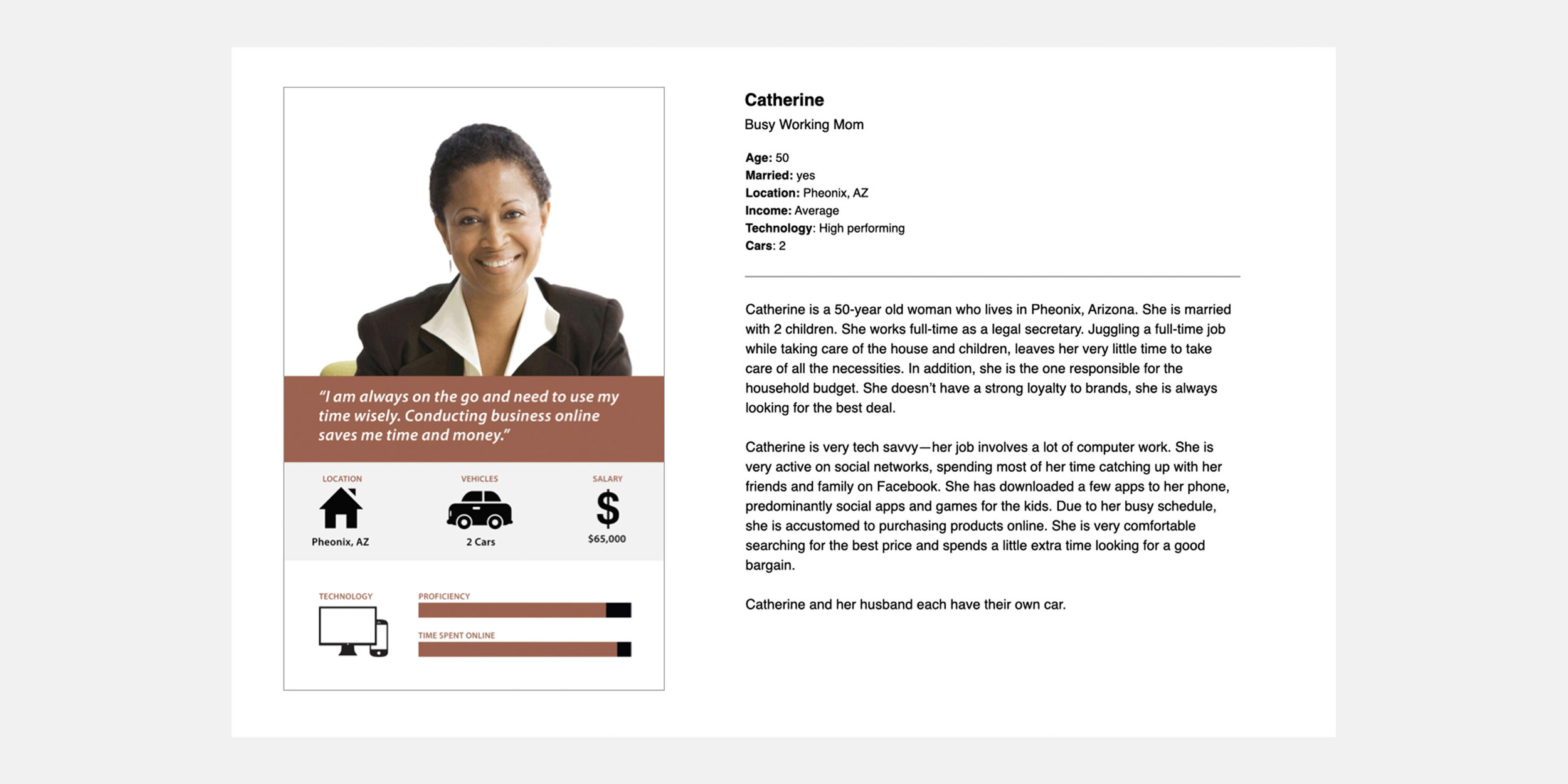

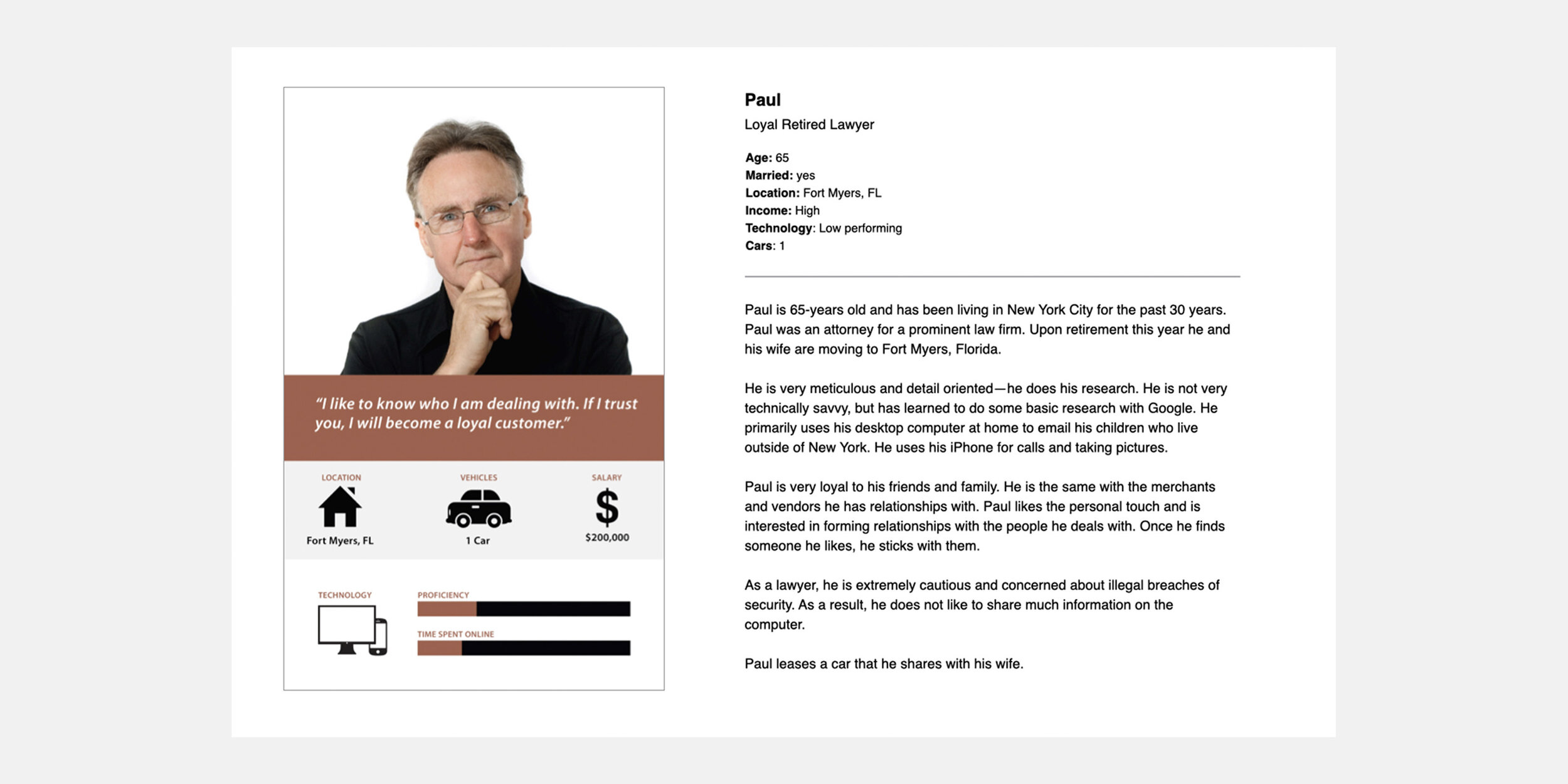

Based on research, data, and interviews, I created three personas (below) which were referenced throughout the workshop. A user journey map was developed to reflect the end-to-end customer experience and to identify gaps in the customer relationship.

Co-Creation / Ideation

After group discussions regarding the customer journey, we broke out into two-person teams for a brainstorming session that resulted in a range of solutions, from drones to mobile apps.

Each team presented their ideas to the group and received feedback. The participants then voted for the ideas that were considered the strongest and most viable solutions to move forward with in Phase I of their customer-centric/digital transformation.

RESULTS: 50+ CONCEPTS

The co-creation workshop generated over 50 concepts. We separated these concepts into 3 distinct categories which represented the customer experience: Accident Avoidance, All About You, Claims Assessment & Submission

WIREFRAMES

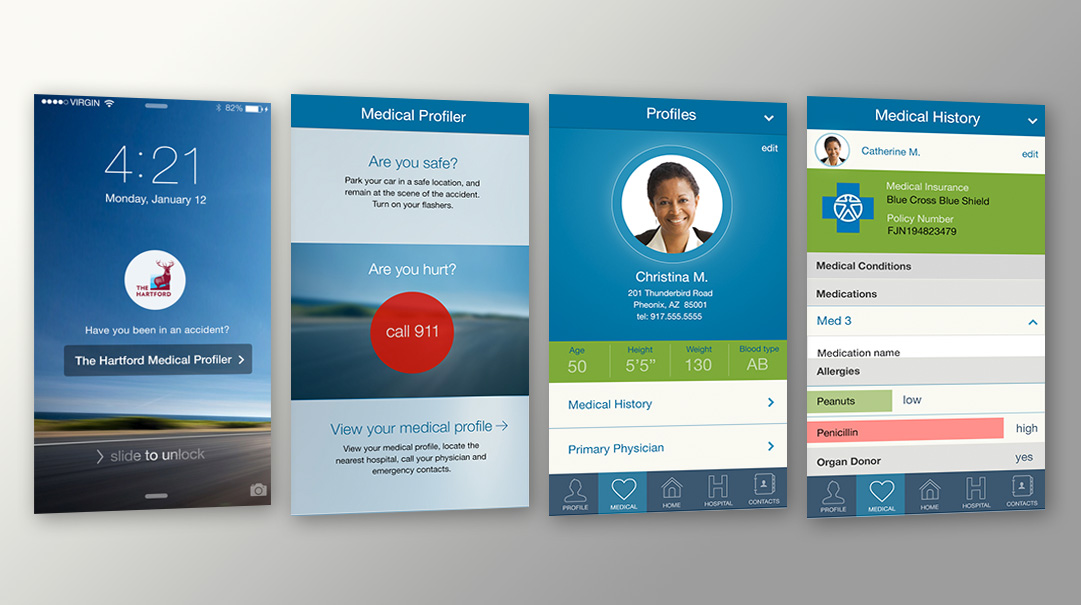

We reviewed the 50+ ideas generated from the workshop and focused on 5 digital concepts. From these initial, rough sketches, I designed wireframes. The Hartford Medical Profiler (see below), was selected to be built out as an interactive prototype.

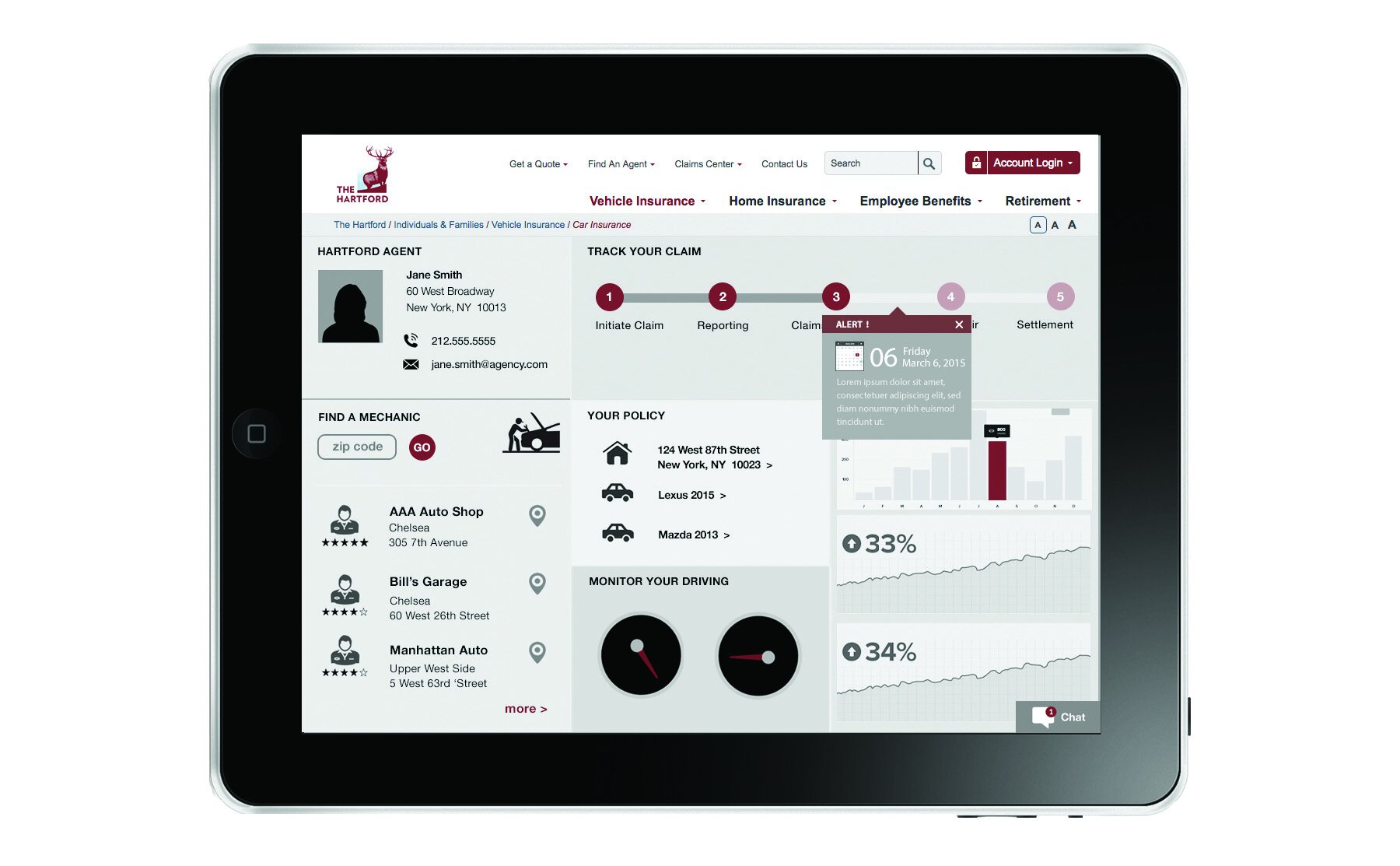

Claims Dashboard

Guides customer through the full life-cycle of their claim from initial accident through insurance settlement.

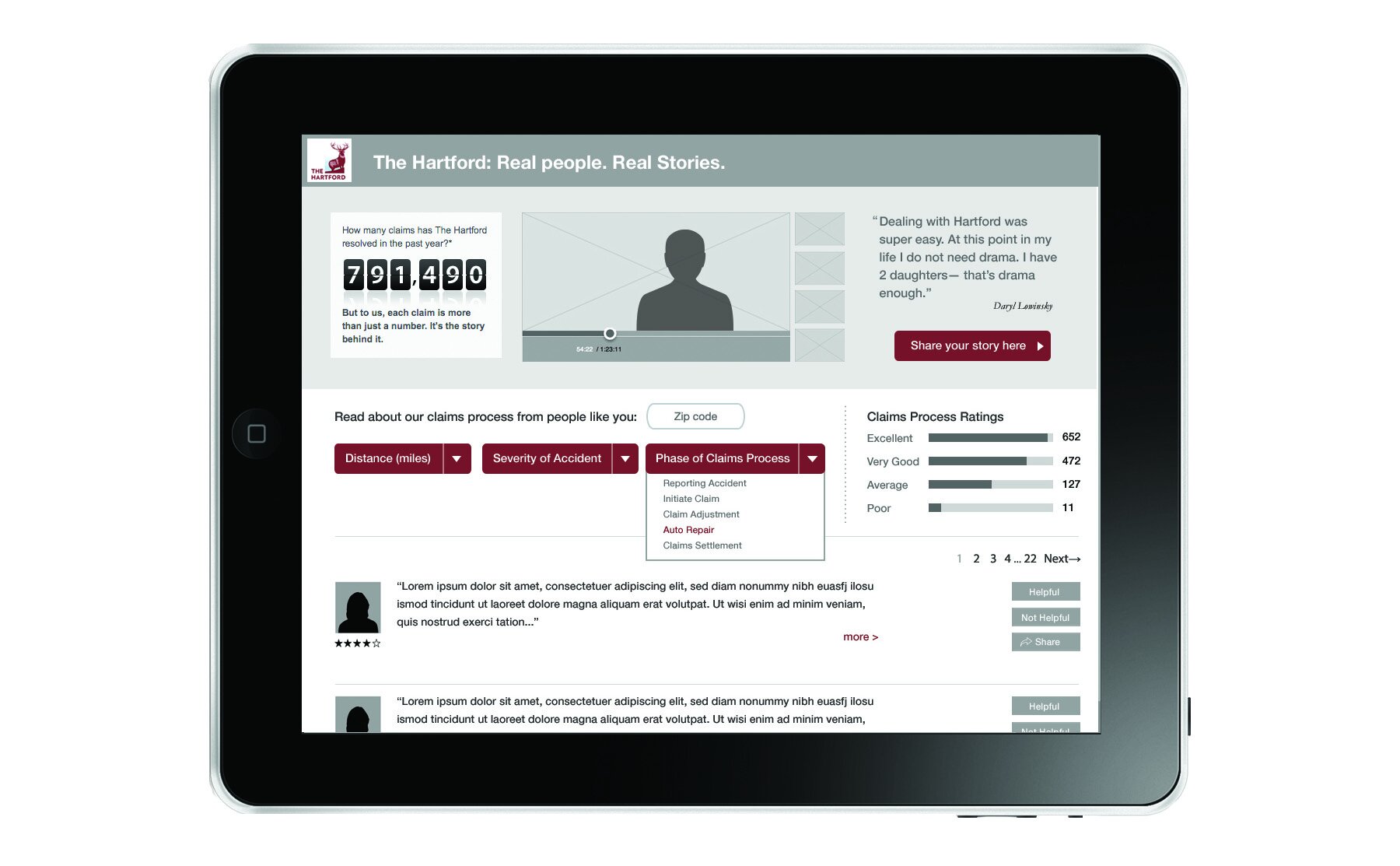

Real Stories

Stories from real customers who experienced accidents. What happened? What lessons did they learn? What steps were necessary to be taken? What was the reimbursement process like?

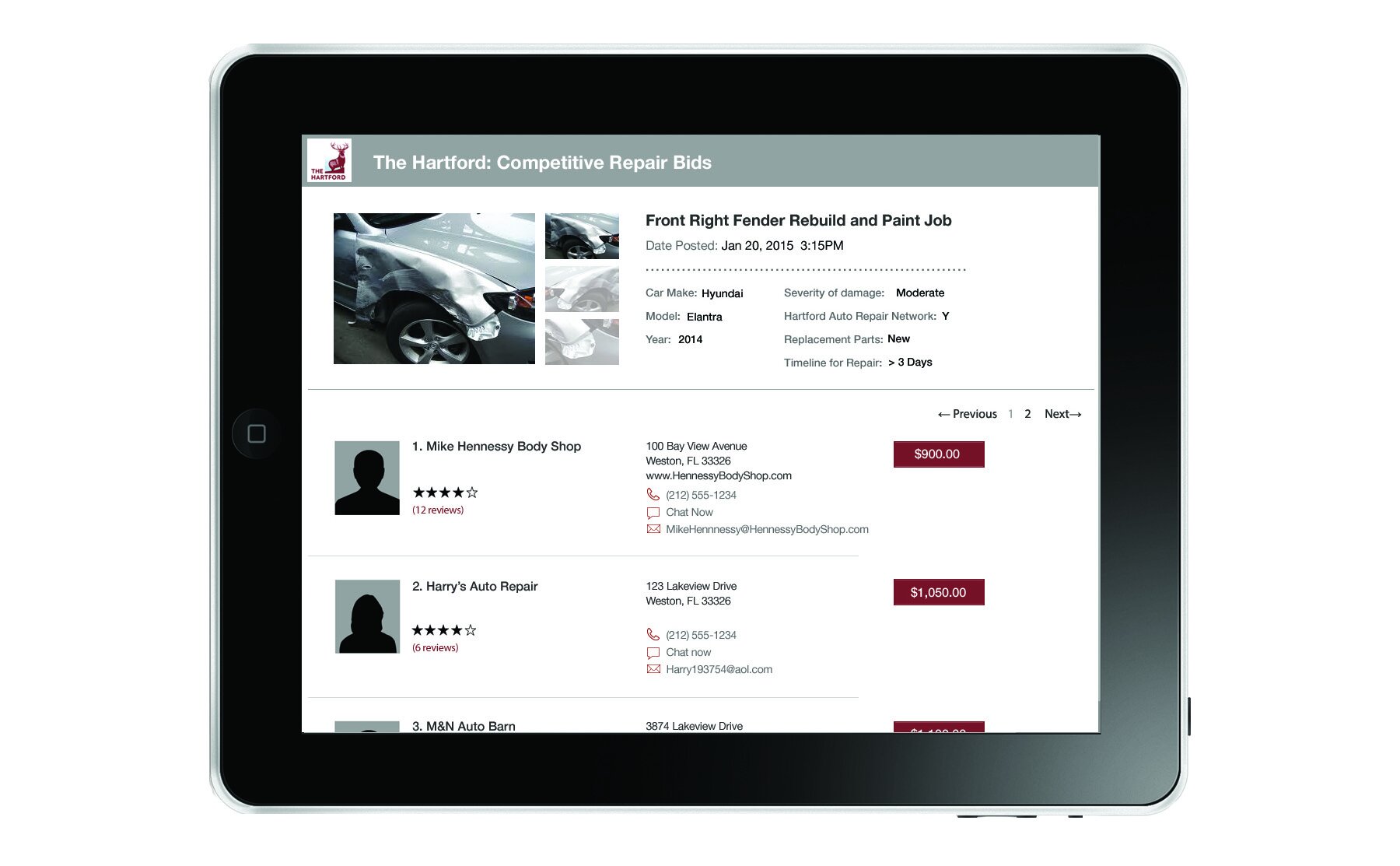

Competitive Repair Bids

Place repairs up for auction in which the auto-repair shop would bid for the business. Customer can view consumer ratings and compare bids. Rates are also shown in relation to insurance reimbursement.

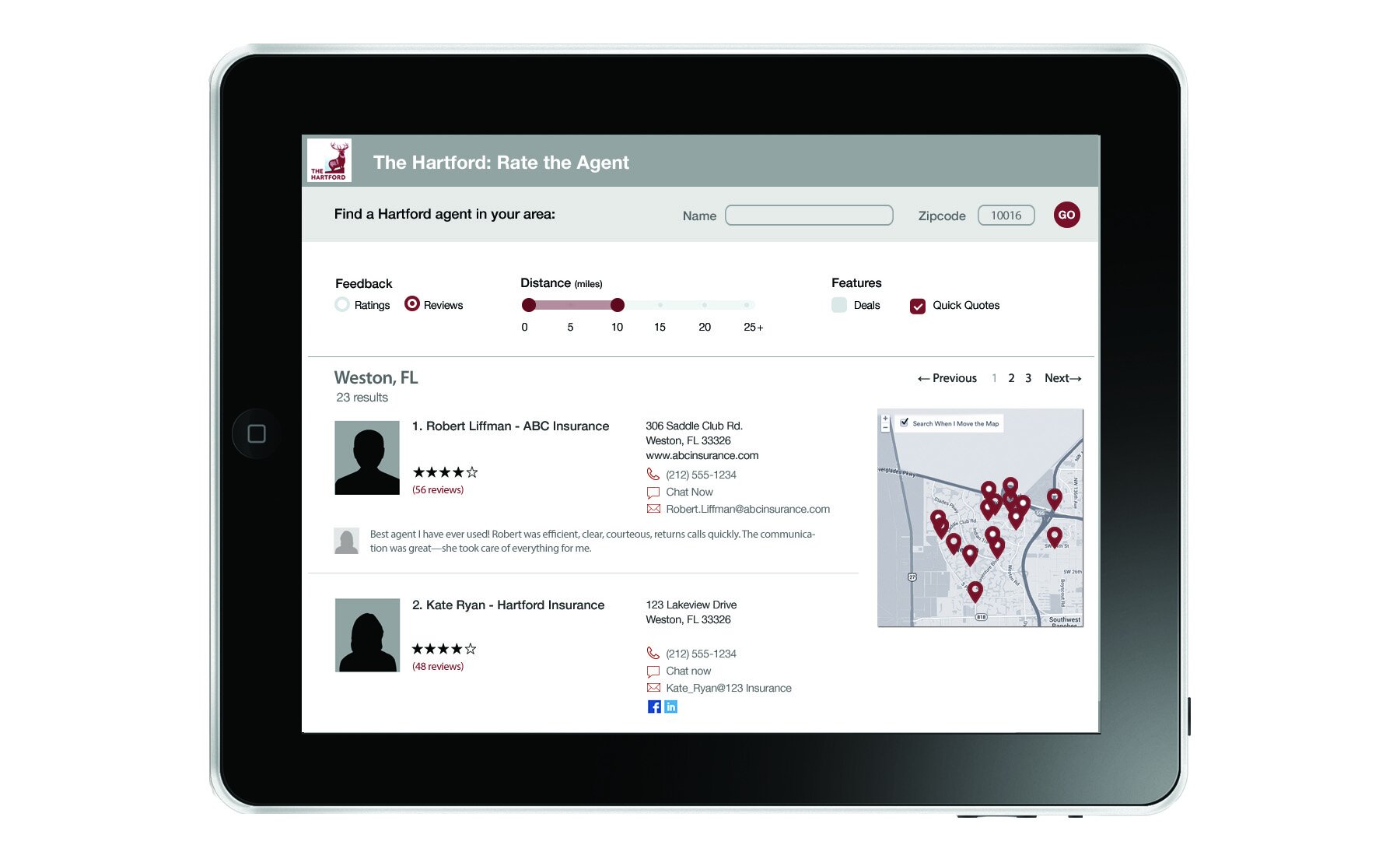

Rate the Insurance Agent

Allow a rating system for insurance agents and vendors included in the claims process.

HARTFORD MEDICAL PROFILER

This mobile app was designed to aid the customer in the event of an accident in which the driver or passenger requires medical attention. The app includes all essential health data, preferred and/or nearest hospital, primary doctor, emergency contact and vital health statistics.